tax

-

- To agree on personal income tax exemption with leading experts in specific fields in Vietnam

- 17:30, 31/08/2023

- On August 30, 2023, the Government of Vietnam issued Resolution 135/NQ-CP on the thematic law-making session in August 2023. In particular, agree to exempt personal income tax with leading experts in specific fields

-

- Cases in which tax debt is eligible and ineligible to be forgiven in Vietnam under Resolution 94/2019/QH14

- 15:59, 03/06/2023

- On May 30, 2023, the General Department of Taxation issued Official Dispatch 2136/TCT-QLN on debt settlement under Resolution 94/2019/QH14 and Circular 69/2020/TT-BTC, which mentions cases in which tax debt is eligible and ineligible to be forgiven in Vietnam

-

- To complete the amendments to tax laws and policies on e-commerce in Vietnam

- 09:35, 01/06/2023

- To complete the amendments to tax laws and policies on e-commerce in Vietnam is the notable point specified in Directive 18/CT-TTg dated May 30, 2023 issued by the Prime Minister.

-

- Vietnam to develop road map to implementation of global minimum tax

- 16:32, 29/05/2023

- This is a content of Directive No. 14/CT-TTg dated May 24, 2023 on tasks and solutions to the improvement of the efficiency of foreign investment in the new stage promulgated by the Prime Minister of Vietnam

-

- The Prime Minister of Vietnam to request effective implementation of the policy of extending, exempting, and reducing taxes

- 14:35, 29/05/2023

- The Prime Minister of Vietnam to request effective implementation of the policy of extending, exempting, and reducing taxes is the notable point specified in Official Telegram 470/CD-TTg In 2023, on continuing to implement drastically and effectively tasks and solutions to remove difficulties for production and business of people and businesses.

-

- Provision of guidance on Decree 68 on prescribing tax administration for enterprises engaged in transfer pricing in Vietnam

- 10:25, 25/07/2020

- Recently, the General Department of Taxation of Vietnam issued Official Dispatch 2835/TCT-TTKT on guiding the implementation of Decree 68/2020/ND-CP on prescribing tax administration for enterprises engaged in transfer pricing in Vietnam.

-

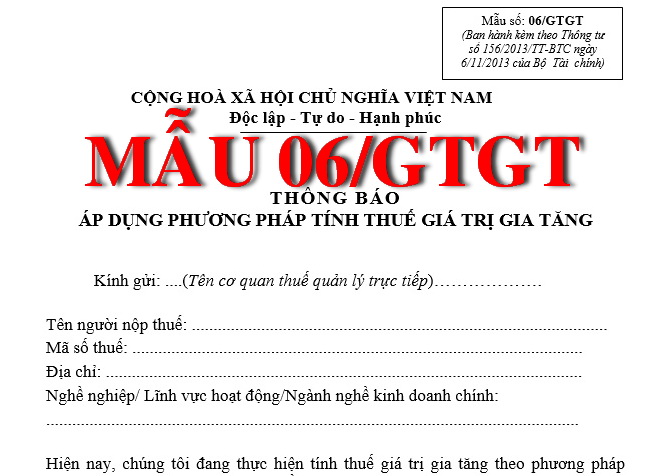

- Vietnam: Abrogating the guidance on submission of Form No. 06/GTGT from November 05

- 15:17, 23/09/2017

- On September 19, 2017, the Ministry of Finance of Vietnam issued Circular No. 93/2017/TT-BTC on amendments to the tax calculation method specified in Circular No. 219/2013/TT-BTC (amended by Circular No. 119/2014/TT-BTC) and amendments to Circular No. 156/2013/TT-BTC.

-

- Pilot electronic PIT declaration for individuals engaged in house rental activities in Vietnam

- 08:36, 13/10/2016

- Recently, the Ministry of Finance of Vietnam issued Decision No. 2128/QD-BTC on the pilot implementation of electronic declaration of value-added tax (VAT) and personal income tax (PIT) applicable to individuals engaged in house rental activities. According to this Decision:

-

- New points of Decree No. 100/2016/NĐ-CP of Vietnam’s Government on taxes

- 17:52, 12/08/2016

- Certain new regulations on value-added tax (VAT), special excise tax and tax administration mentioned in Decree No. 100/2016/NĐ-CP of Vietnam’s Government will effective from July 01, 2016 have contributed to ensuring the rights and obligations of businesses in declaring, paying and finalizing taxes according to the provisions of law.

Most view

SEARCH ARTICLE