Personal income tax

-

- Vietnam: Is it mandatory to pay PIT and VAT when renting a house?

- 11:25, 28/07/2020

- I own a 3-story house in District 1. I currently do not need to use it and want to rent it out. I want to ask if I want to rent this house, do I need to pay PIT and VAT? Also, do I have to pay any other taxes in accordance with Vietnam’s regulations?

-

- Vietnam: Shall Tet bonus in 2019 be subject to personal income tax?

- 09:18, 18/01/2019

- The end of the coming year is also the time when businesses pay Tet bonuses and 13th month salary to employees. So, shall this amount of bonus be subject to personal income tax?

-

- Assessment of incomes liable to personal income tax of automobile and motorbike traders using tax imposition method in Vietnam

- 13:05, 11/05/2010

- Recently, the Ministry of Finance issued Circular 71/2010/TT-BTC guiding tax assessment for automobile and motorbike traders that write the prices of automobiles and motorbikes on invoices issued to consumers lower than normal market prices, which stipulates regulations on assessment of incomes liable to personal income tax of automobile and motorbike traders in Vietnam.

-

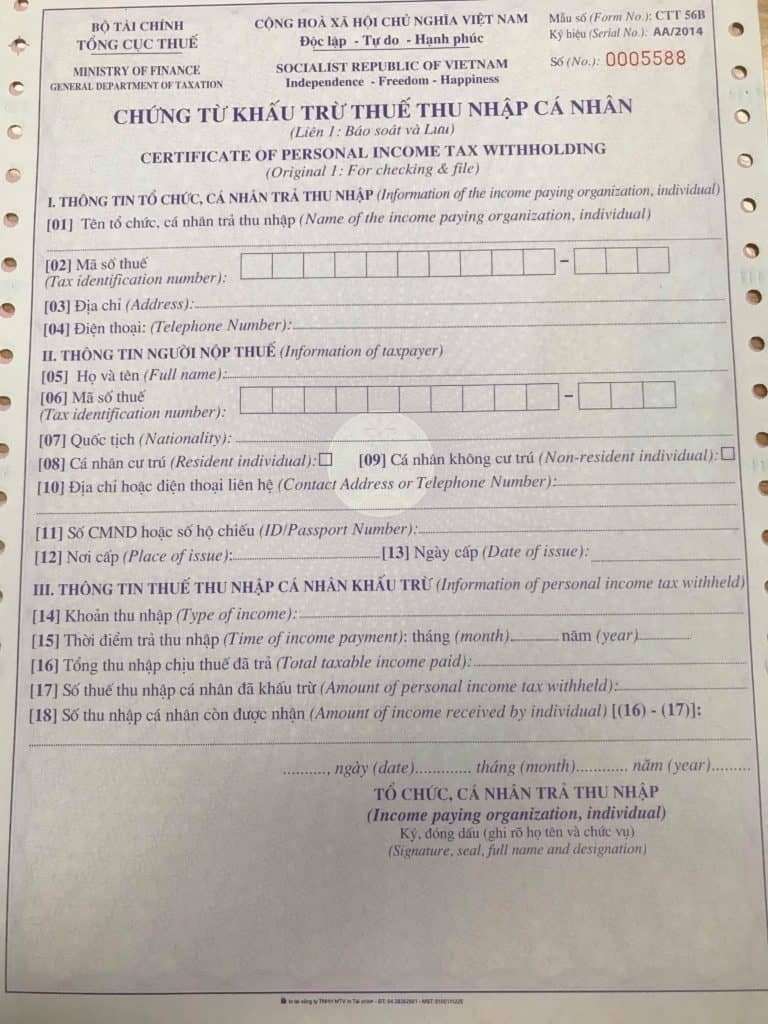

- General regulations on certificates of personal income tax withholding printed out from computers by income payers in Vietnam

- 09:47, 19/03/2010

- General regulations on certificates of personal income tax withholding printed out from computers by income payers in Vietnam are specified in Circular 37/2010/TT-BTC guiding the issuance, use and management of certificates of personal income tax withholding printed out from computers by income payers.

Most view

SEARCH ARTICLE