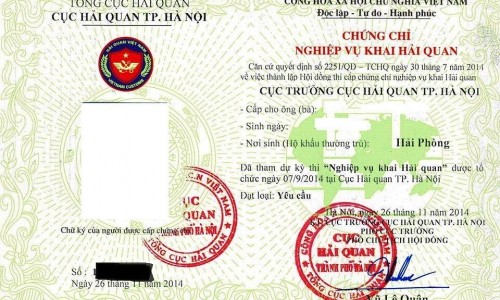

Vietnam: Cases of exemption for examination for certificates of training in customs according to new regulations

This is a notable content specified in Circular No. 22/2019/TT-BTC of the Ministry of Finance of Vietnam on amendments to Circular No. 12/2015/TT-BTC on guidelines for procedures for issuance of certificate of training in customs declaration; issuance and revocation of customs broker number; procedures for recognition and operation of customs brokerage agents.

According to Vietnam’s new regulations, exemption for examination for certificates of training in customs is as follows:

- Exemption from examination in the subject named Customs law and customs professional practices shall be granted to:

+ A graduate in customs major from a university or college who applies for examination to obtain certificate of training in customs declaration 3 years from the date of graduate;

+ An examinee who used to be a lecturer in customs major at a university or college and had been working there for at least 5 years and applied for examination to obtain certificate of training in customs declaration 3 years from the date on which he/she received a decision on reassignment, retirement or resignation.

- Exemption from examination in the subject named Foreign trade professional practices shall be granted to:

+ A graduate in foreign trade, international trade, external economics, international economics or logistics and supply chain management major from a university or college who applies for examination to obtain certificate of training in customs declaration 3 years from the date of graduate;

+ An examinee who used to be a lecturer in foreign trade, international trade, external economics, international economics or logistics and supply chain management major at a university or college and had been working there for at least 5 years and applies for examination to obtain certificate of training in customs declaration 3 years from the date on which the decision on reassignment, retirement or resignation is issued (excluding the job dismissal).

View eligibility for exemption at Circular No. 22/2019/TT-BTC of the Ministry of Finance of Vietnam, effective from July 01, 2019.

- Thanh Lam -

- Key word:

- Circular No. 22/2019/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Amending regulations on shutdown of customs brokerage ...

- 14:50, 26/04/2019

-

- Vietnam: Cases of exemption from examination for ...

- 10:05, 26/04/2019

-

- Cases of suspension of customs brokerage agents ...

- 17:24, 21/04/2019

-

- Vietnam’s new regulations on examination application ...

- 16:30, 21/04/2019

-

- 07 cases of shutdown of operation of customs brokerage ...

- 15:22, 21/04/2019

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents