Guidelines for Determining Profit, Post-Tax Return on Equity

Circular 12/2018/TT-BTC was issued by the Ministry of Finance on January 31, 2018, providing specific guidance on determining after-tax profits and after-tax profit rates on equity.

According to Circular 12, post-tax profit is defined as net profit from business activities after deducting credit risk provisioning expenses and current corporate income tax expenses, refundable corporate income tax expenses;

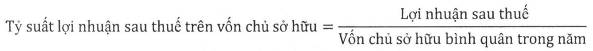

The post-tax return on equity ratio is determined by the following formula:

In which:

- Post-tax profit is determined as mentioned above

- Average equity for the year is determined by the following formula:

Circular 12 also stipulates that equity is derived from the equity item on the balance sheet of the credit institution, including: the capital of the credit institution, funds of the credit institution, exchange rate discrepancies, re-evaluation of assets discrepancies, and undistributed profits.

See details Circular 12/2018/TT-BTC effective from March 19, 2018.

-Thao Uyen-

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents