-

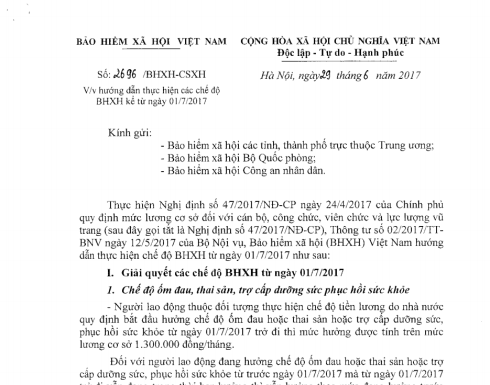

- Hanoi-Vietnam: Guidelines for settlement of social insurance benefits from July 1, 2017

- 13:45, 11/07/2024

- On June 29, 2017, Vietnam Social Security issued Official Dispatch 2696/BHXH-CSXH providing guidance on settlement of social insurance benefits under the new statutory pay rate.

-

- Detailed procedure for resolving social insurance and health insurance formalities via postal services in Vietnam

- 13:44, 11/07/2024

- According to the recent guidance of Ho Chi Minh City Social Insurance in Decision 262/QD-BHXH, individuals carrying out administrative procedures such as registration, selecting social insurance policy dossiers, social insurance disbursement, notarization, social insurance book, health insurance card, health insurance payments, etc., through the public service system shall follow the process diagram below:

-

- Conditions for Participation in Social Insurance via Electronic Transactions - Draft

- 13:21, 11/07/2024

Social Insurance Procedures

Social insurance procedures are among those that are closely linked to the daily lives of workers. Therefore, the Government of Vietnam has implemented the "digitization" of procedures for participation in Social Insurance (BHXH), Health Insurance (BHYT), and Unemployment Insurance (BHTN) to reduce the time and costs for both workers and social insurance agencies. It is hoped that there will no longer be scenes of "crowding for hours" to submit or withdraw Social Insurance records.

-

- Hanoi-Vietnam: Guidance on collection of voluntary social insurance and family-based health insurance premiums

- 13:20, 11/07/2024

- Recently, Ho Chi Minh City Social Security issued Official Dispatch No. 2305/BHXH-THU providing guidance on the collection of voluntary social insurance and family-based health insurance premiums. To be specific:

-

- Hanoi-Vietnam: New regulations on paying social insurance premiums and receiving social insurance benefits from January 01, 2018

- 13:20, 11/07/2024

- Law on Social Insurance 2014 is effective from January 01, 2016. However, some provisions of this Law will officially take effect in 2018. The regulations on paying social insurance premiums and receiving social insurance benefits in Vietnam are as follows:

-

- Hanoi-Vietnam: From January 1, 2018, increase of the salary serving as the basis for social insurance premium payment to 4,258,600 VND

- 13:19, 11/07/2024

- From January 1, 2018, the increase in region-based minimum wages leads to an increase in a series of salary deductions. Notably, the salary serving as the basis for social insurance premium payment of employees in enterprises from 2018 in Vietnam is adjusted as follows:

-

- Hanoi-Vietnam: Increase of the social insurance premium paid by employees from January 01, 2018

- 13:16, 11/07/2024

- Recently, the Government of Vietnam has issued Decree 141/2017/ND-CP regulating the increase of region-based minimum wages for 2018, effective from January 1, 2018. Therefore, the social insurance premium paid by employees from January 1, 2018, will be subject to change. To be specific:

-

- Enjoy 100% Medical Examination and Treatment Costs if the Health Insurance Card States "Eligible Time for 05 Consecutive Years"

- 13:15, 11/07/2024

- From January 1, 2015, individuals holding a health insurance card (BHYT) who have participated in health insurance (BHYT) continuously for a period of 5 years or more, and have co-payment amounts for medical examination and treatment (KCB) at the correct level exceeding six months' statutory pay rate within the year, will be entitled to 100% coverage of the KCB costs.

-

- Details of Contributions Included and Excluded from Social Insurance from 2019

- 13:05, 11/07/2024

- At present, many individuals have not clearly determined which income items are subject to social insurance contributions. In response to numerous inquiries from members and readers, Legal Secretary has compiled a detailed categorization of items included in wages and items not included in wages for social insurance contributions.

-

- Guidelines for Social Insurance Code Lookup

- 12:59, 11/07/2024

- According to the recent directive in Official Dispatch 1919/BHXH-QLT, Ho Chi Minh City Social Insurance requests relevant agencies and units to guide participants to review their social insurance numbers, supplement personal information to complete the issuance of social insurance numbers for participants as a basis for the issuance of health insurance cards from January 1, 2018.

Most view

SEARCH ARTICLE

JUST UPDATED

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Most view